EU Reverse Charge VAT Now Supported

Cross-border B2B transactions within the EU often fall under the reverse charge mechanism. With the latest update to Reinos Store Tax, we now fully support this.

When enabled:

- VAT numbers are validated for all EU countries

- Invoices automatically include this legal notice:

This invoice uses the reverse charge mechanism under Article 17 of the VAT Act.

No VAT is charged by the supplier. Instead, as the buyer, you are required to calculate, report, and pay the applicable VAT in your own country via your VAT return.

This helps ensure your invoices meet legal standards for EU intra-community trade.

Smarter Tax Handling with State-Level Support & One-Click Imports

Managing regional taxes just got easier:

- Per-state/province tax support — useful for businesses in the USA and Canada

- One-click import of full tax rate sets for:

- EU countries

- Canadian provinces & territories

Whether you're dealing with complex VAT rules or regional sales taxes, setup is now faster and more accurate.

Professional and Legally Compliant Invoices

- Reinos Store also received a major update focused on document generation and invoice customization:

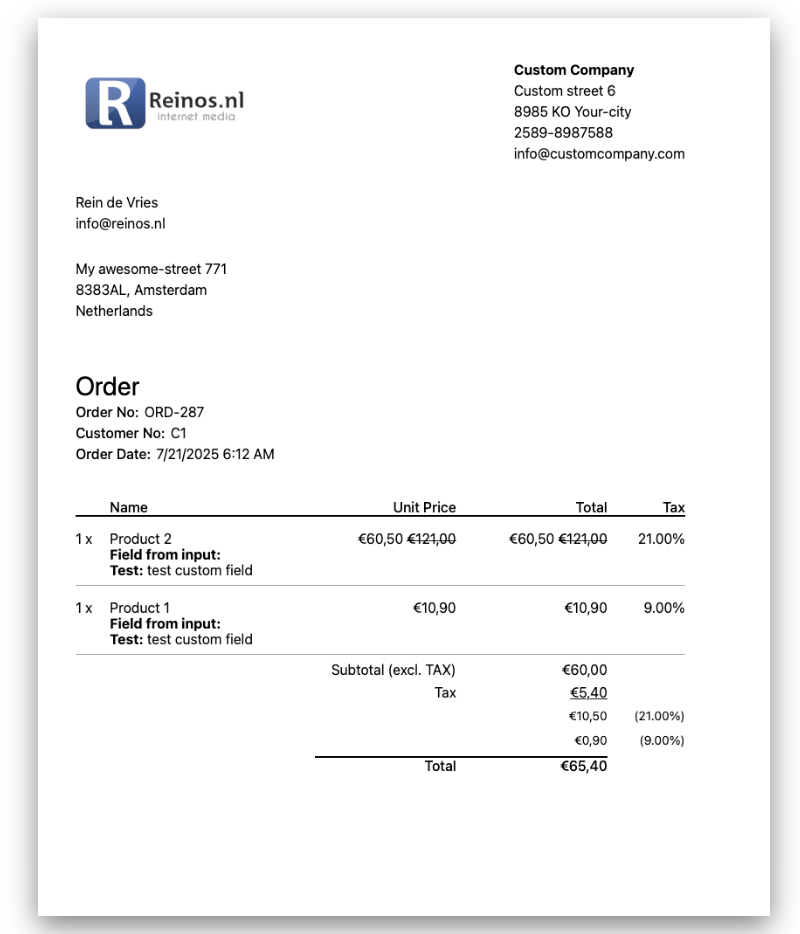

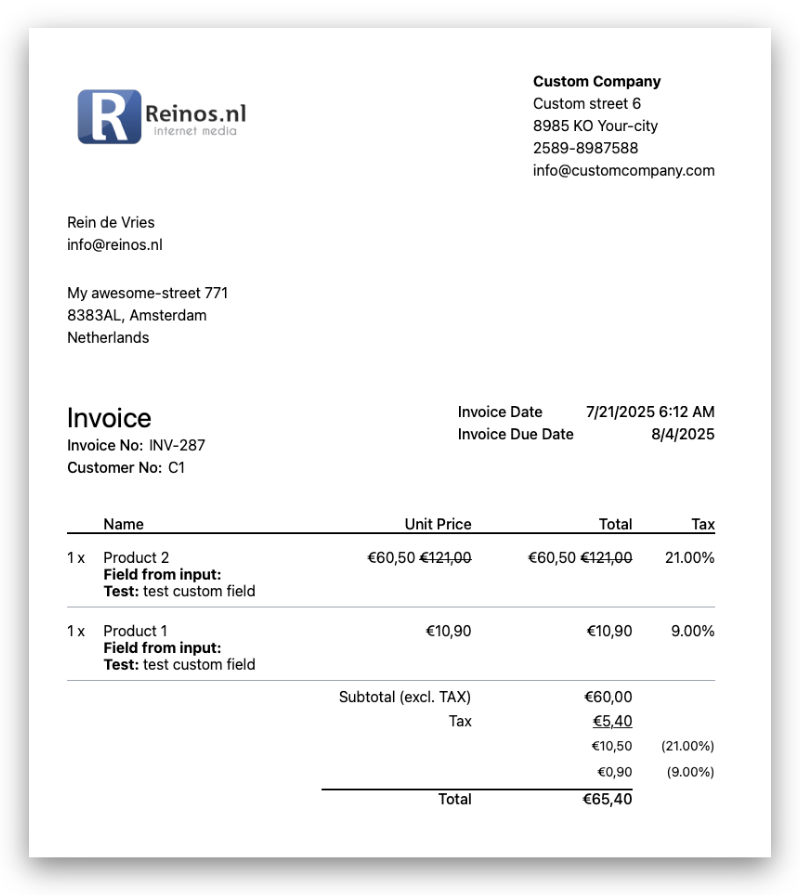

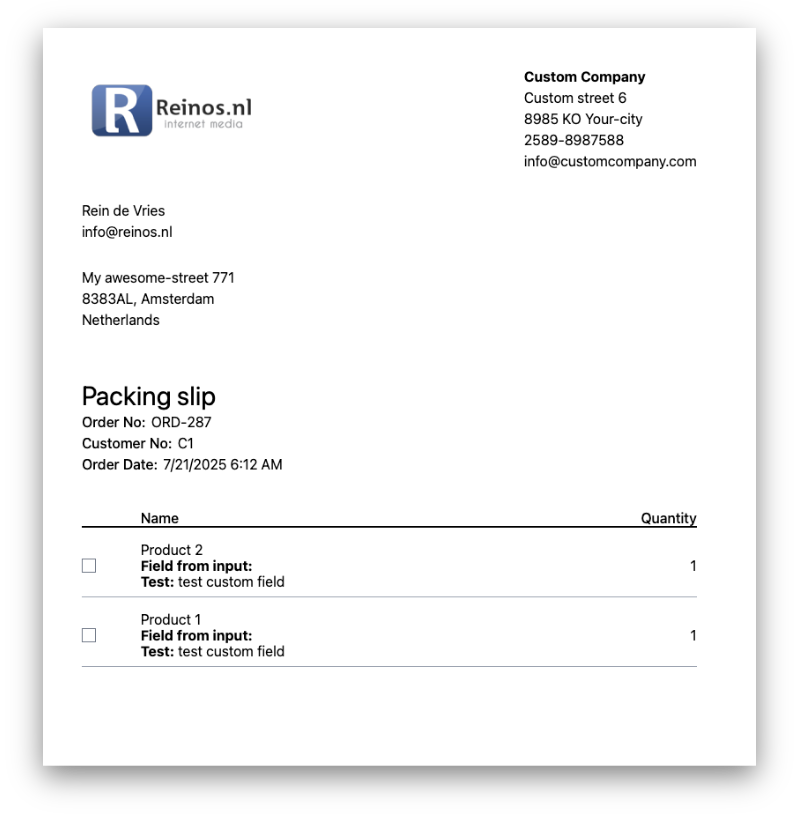

- Generate PDFs for invoices, order confirmations, and shipments

- Add custom prefixes and footers to each document type

- Set the number of due days shown on the invoice

- Improved support for tax-inclusive pricing

- New fields for better bookkeeping:

- is_paid (order)

- is_reverse_charge_eu (order and cart)

- With these improvements, your PDF output is now clean, structured, and legally compliant for most jurisdictions.

Order

Invoice:

Picklist:

We also have added these PDF support for the frontend by adding the following template tags

{exp:reinos_store:download order_hash="{order:hash}" type="confirmation"}

{exp:reinos_store:download order_hash="{order:hash}" type="invoice"}New: Editable Order Overview

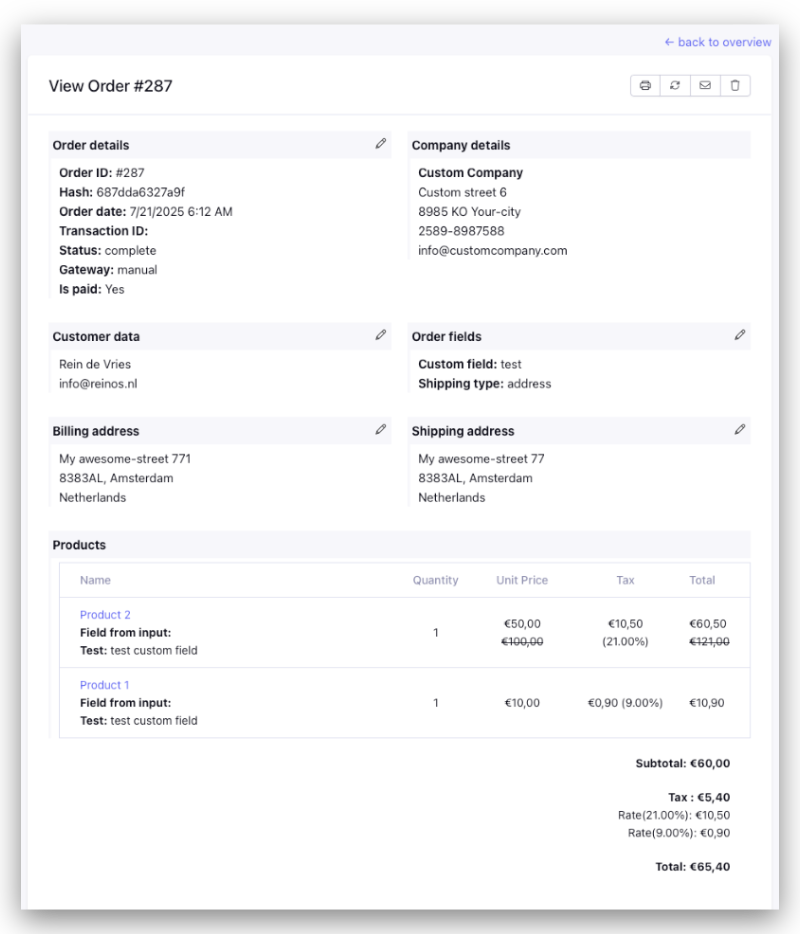

One of the most requested features is finally here!

The order overview screen in the control panel has been completely redesigned to allow editing of existing ordersdirectly from the list.

This means:

- No more clicking through multiple screens

- Faster updates to order details

- Better workflow for support and fulfillment teams

Example below:

NEW: Tax Breakdown with {cart:tax_details}

From version 3.6.0, Reinos Store includes a new template tag pair to show a clear tax summary per cart:

{cart:tax_details}

{cart:tax_details:info}

{cart:tax_details:high_rate}

{cart:tax_details:high_amount}

{cart:tax_details:high_amount:formatted}

{cart:tax_details:low_rate}

{cart:tax_details:low_amount}

{cart:tax_details:low_amount:formatted}

{/cart:tax_details}Perfect for showing low and high tax rates directly on your cart or invoice templates.

Full Changelogs

Want to dive deeper into all recent updates? View the full changelogs here:

- Reinos Store Changelog: docs.reinos.nl/store/changelog.html

- Reinos Store Tax Changelog: docs.reinos.nl/store-tax/changelog.html

7/28/2025